|

Trading: how to do it right

By Scott Tafel

By Scott Tafel

Anyone who trades would like to know how the Pro's do it. I have spoke with many of them and compiled this guide to help you understand

the proven methods of trading by independent professional traders rather than some secret method that somebody "discovered" and will teach

you after you pay them a lot of money. Be sure to see some of the other related articles (and sub-articles):

how to trade and how to be a trader.

Getting into a trade is given a great deal of weight by non-professional traders but there are equally important skills needed in risk

management and good exits. It is OK to get into a bad trade as long as you manage it well. As a starting or intermediate trader it will

be your skill at running with good trades and cutting bad trades short that will make you profitable because you will have more bad

trades at this stage than you will later on with more experience. We will discuss exits in more detail later on. Trade entry methods are

usually applicable to a wide range of time frames so we will lay a good foundation here and then apply them in the day trading, swing

trading, position trading, and scalping articles.

|

Why does trading work & what results to expect

Let's compare trading to a skilled profession to understand the important differences. In a skilled profession where you are the craftsman you perform a

sequence of tasks based on your experience. You are largely in control of the future events that will complete the job. In trading you cannot control any

future events in the market.

If you saw a person walking down the street then how accurately could you predict his action in the next

minute? 15 minutes, hour? day? week? month? With each time frame extension the information you have gained

over the last few minutes becomes less relevant and future outcomes are less reliable. However, what if you

knew a lot about this person: you knew what their car looked like, where they lived, worked, and their

favorite places to eat. With this information you could make accurate general predictions of their most

likely actions on a longer time frame. You can't account for illness, dentist appointments, and other

less predictable changes in their patterns. It is the recognition and use of patterns that we use to

trade the markets. It is impossible to perfectly predict the outcomes of patterns due to the number of

unknowns that still exist, so we settle for 58-60% as a sign of excellent performance. With proper risk

management and exit management we can be profitable down to 50% winners.

Sports betting is quite similar to securities trading. A good record for a sports bettor is any record

equal to or larger than 52.4%, because that number or anything higher means you’re not losing money.

A 53% winning record, while not impressive on paper, means you’re actually beating the sports book and

putting money back in your pocket. If you bet through an organized betting establishment then you odds

are much lower because they will skim 10% from the betting. This does not occur in securities trading.

|

|

There are three elements to successful trading

The first element is the trade entry. The second is the size of the trade. The third is the exit. All three must be done reasonably well for you to be successful.

In the next page we will start with the trade entry. In the last section we will discuss exits. For the remainder of this section we will discuss how much to trade.

Let's play a coin flip game. Heads you win $1, tails I win $1. The only difference is I have infinite money, and you have $100. Even though the coin flip

is a 50/50 chance, this game will end with me having all of your money. The reason is, once you lose your last dollar on the inevitable losing streak,

you don't have any more dollars to bet against me. In trading the risk and reward do not need to be equal. If your profit target is $75 and your stop loss is

$50 then you will make money when you play me if you don't bet too much. Never forget that high bets will wipe you out on even a short losing streak. Calculating

the right amount to trade is not hard and is covered below on this page.

Ralph Vance did an experiment with 40 PhD's in which they would gamble 100 times in a game where they would be guaranteed to win 60% of the time. They started out

with $1,000. If they had bet exactly $10 on each round they would have each had $1,200 left at the end of the test. If they had bet the mathematically optimal

amount of 20% (the Kelly Value below) then they would have had $7,490. However, only 2 had more than $1,000 at the end of the test. Over

sized bets is not unusual among traders and is the reason for trading disasters that happen to some of them.

|

Trading How To: Calculating trade size

In probability theory, the Kelly strategy is a formula used to determine the optimal size of a series of trades. In most trading scenarios the Kelly strategy

will do better than any other in the long run. It was described by J. L. Kelly, Jr in 1956. Kelly mathematicians (and me) usually argue for fractional

Kelly (betting a fixed fraction of the amount recommended by Kelly) for a variety of practical reasons. The Kelly formula does not account for

non-deterministic events (variations in results due to unpredictable short term variations in the winning percentage). In recent years, Kelly has

become a part of mainstream investment theory and well-known successful investors including Warren Buffett and Bill Gross use Kelly methods.

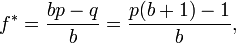

If your winning

percentage is 60% and your risk/reward is 1.5:1 then the formula would be .33 =

(1.5*0.6-0.4)/1.5 or 33%. I like to use a fractional value of 20%-25%.

So if you have a $5,000 account with 60% winners and a 1.5 risk/reward ratio then your Kelly value would be $1,666. Multiply $1,666 by the fractional

value of 20-25% then you get $333-$417. Therefore $333-$417 is your maximum stop loss for the entire trade. Do not enter a trade unless you can use a

$333-$417 stop loss on the entire trade, you have a profit target of $500-625, and your winning record is about 60%. To the extent that you do not follow

these calculations your risk of losing your entire account becomes significantly greater than zero.

|

- f* is the fraction of your account to trade

- b is the risk/reward ratio

- p is the winning percentage

- q is the losing percentage

|

Scott Tafel is the founder and principle partner in Falcon Trading Systems: computers for traders. He has

been a trader since 1999. Mr. Tafel spent 27 years working in the Nuclear power industry, principally as a

Nuclear Reactor Operator.

|

|

|

By Scott Tafel

By Scott Tafel