|

Opening a New Trade

When we open a new trade it is a thoughtful process of weighing the risks vs. rewards

and the probability of a successful outcome. We study the charts for familiar patterns

and seek secondary confirmation from other sources of information.

In the previous example of predicting the future actions of a person walking down the street, we want

to look for patterns that repeat. If that person walked into a restaurant at lunch time then we could

predict that he would remain in that establishment and eat for 30-60 minutes. He might just use the

bathroom and take only 10 minutes, but at least 60% of the time he will eat, so we have a good trade

on that information. There are many other similar patterns like playing sports, going to work, etc.

that we could eventually define that would give us good predictive value. In the same manner we look

for patterns in the market that will give us short term information on what the market will do next.

|

|

Where to look for Patterns

There are three places to look for patterns: 1) In the raw price action itself, 2) At derivatives of the

raw price action, and 3) In indicators that have the price action as an input.

The Raw Price Action

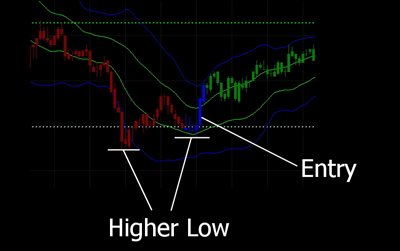

The following bullish patterns use the raw price action in that the charts have not had their appearance

altered and we are not relying on any indicators. These are reversed for bearish trades. The picture at

the top right of this page is an example of the use of higher lows off of a support level. The pictures

below represent examples of some common patterns. There are whole books written on them so we won't

cover them in detail here but I am showing you my favorites.

|

|

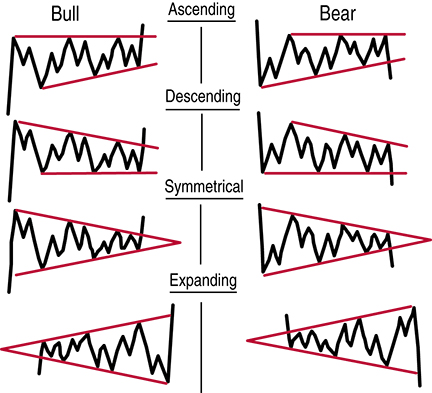

These types of patterns are little gold mines when they occur, but we will need more ways to

trade because you may not see them often enough each week. The chart at the right shows the

most frequently occurring intra-day and daily patterns.

If you trade stocks then you will see these patterns more often due to the large number of

stocks to pick from, but you will need to do a lot of looking each day.

I am going to look at support and resistance patterns separately on the next page. We will also look at

some candlestick patterns.

|

|

Derivatives of Price Action

Renko bars, Range Bars, and P&F charts are often seen as magic tools to trade successfully. This is

mostly because they look great in retrospect. As long as you just look at historical patterns it looks

like easy money. In real time trading it is not so clear and traders are often no more successful than they

were with regular charts. Day traders often use tick volume bars, which is a good alternative to time based

bars (the bars look like regular bars but they are based on trade volume not time).

I have seen people refuse to entertain anything other than a range bar chart because they were convinced

that these charts held the secret to success and everything else was inferior, but they could not get them

to work. It is usually just a mirage but some people are successful with them.

If someone is praising the virtue of a funky looking chart, always ask him how much money he is making with

it. I had to look through a lot of charts to get one that looks as clean as the one on the right. The rest of

the charts looked pretty untradeable.

|

|

|

Indicators

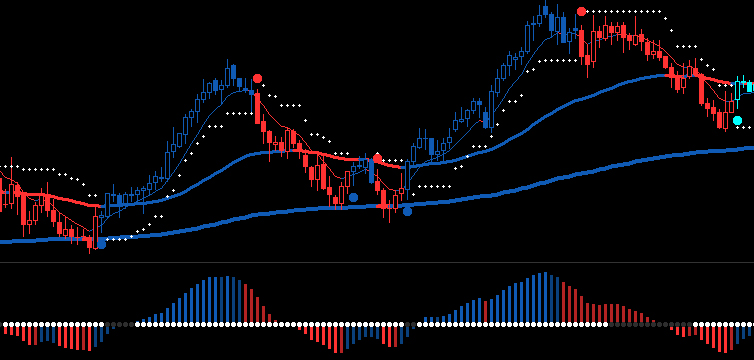

Indicators are a way of smoothing out the price action or to mathematically evaluate it. Indicators can remove the

short term noise to see the underlying trend. They can also be used to establish rules that will keep your trading

consistent. For example. you could use two moving average lines and only buy when the faster moving average is

above the slower one and only sell when the faster moving average is below the slower one. If it helps you to be

consistent then it can make you more profitable by giving you consistent action points. The below indicator set is

an example of a number of similar packages that can help you make better choices.

|

|

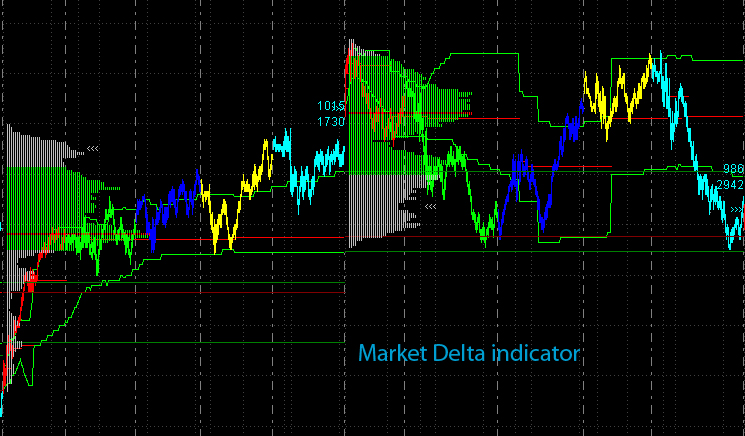

| This type of indicator will require much more training to use: |

|

Scott Tafel is the founder and principle partner in Falcon Trading Systems: computers for traders. He has

been a trader since 1999. Mr. Tafel spent 27 years working in the Nuclear power industry, principally as a

Nuclear Reactor Operator.

|

|

|